Crypto Market Cap Calculator

What Is Market Cap?

Market Cap – short for Market Capitalization – represents the total value of all coins or tokens for a specific cryptocurrency at that point in time. Market cap isn’t only used in crypto markets, it’s also used in the share market to calculate the market cap of companies and in the commodities market to calculate the market cap of materials like gold or silver.

Why Calculate Market Capitalization?

Investors calculate market cap to help determine the total value of the cryptocurrency and its scope. This helps them to better understand its risk and return profile.

When it comes to a company, the larger the market cap, the more stable it usually is. This often translates to lower returns and lower risk for the investor. Conversely, a company that has a small market cap usually has higher returns and higher risk.

This relationship makes market cap a good tool for investors to use with stocks, however the stock market is well established with 100+ years of history. Cryptocurrencies are barely a decade old. So while it might seem like it makes sense to calculate the market cap of cryptocurrencies just like you would for a company, it kind of misses the forest for the trees.

As we’ve gone into multiple times before, we do not recommend investors consider any cryptocurrency except Bitcoin and what market capitalization it has doesn’t change this. This is because of fundamental underlying issues like who is in control of the crypto, how decentralized it is and much more. We have two main pieces explaining this in more detail:

How To Calculate Cryptocurrency Market Cap

Calculating market cap is extremely simple, all you need to know is the price of an individual coin/token and the total number of coins/tokens for that cryptocurrency. Importantly this is the total number of coins/tokens that are available at the current point in time.

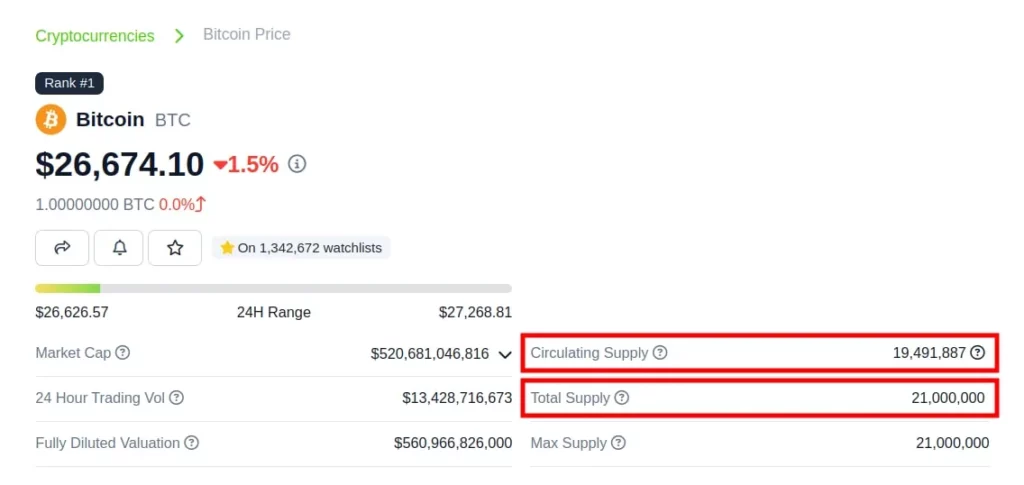

For example, Bitcoin has a hard cap of 21 million bitcoin baked into its code. There will never be any more than that amount, however that’s not how many bitcoin are in circulation right now. Currently there are 19,805,500 bitcoins that have been minted. The remaining 1.5+ million bitcoins will be minted over the next 100+ years due to the Bitcoin Halving.

When you calculate the market capitalization ensure you use the current circulating supply value, not the total supply value.

>> Learn More: How Many Bitcoins Are There?

Market Capitalization Formula

Calculating market cap is done by multiplying the current price of the coin by the total circulating supply.

Market Cap = Coin Price x Circulating Supply

A good cryptocurrency price website like CoinGecko will tell you both the coin or token price as well as the current circulating supply. As mentioned before, you need to know the current circulating supply, not the total.

Market Capitalization Example

Using the above (obviously a bit old) info on Bitcoin, let’s see how it looks in practice:

- Bitcoin Price: $26,674.10

- Circulating Supply: 19,491,887

- Market Cap: $26,674.10 x 19,491,887 = $519,928,543,026.70

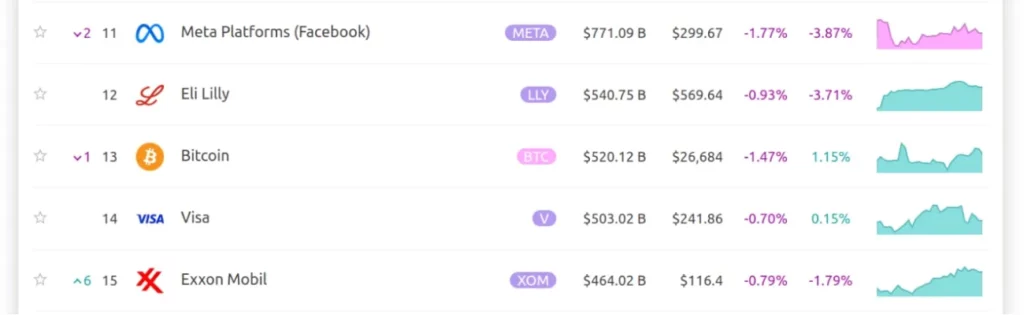

This tells us that the entire market of Bitcoin used to be worth roughly $520 billion dollars at this point in time! With this we can then compare it to other asset classes to see how big or small Bitcoin is by comparison. We can also compare it with other individual large cap companies or even countries.

What Is A Fully Diluted Market Cap?

As mentioned, there are currently around 19,491,887 bitcoins that have been minted. When we calculate the market cap for Bitcoin, we use this number as the circulating supply.

To find the fully diluted market cap, we instead use the final, full amount of bitcoin that will ever exist or 21,000,000. At the current Bitcoin price of $26,674.10, this is:

$26,674.10 x 21,000,000 = $560,156,100,000

The fully diluted market cap of a particular coin should be bigger than just the normal market cap and is useful to compare various coins or companies as it gives you a full picture of what the future can hold.

Calculating A Company’s Market Cap

To calculate the market cap of a company you perform the same multiplication step, but this time with the companies stock price and total number of publicly traded shares. So the formula becomes:

Market Cap = Share Price x Number Of Shares

As a companies stock price and number of shares varies over time, this means its market capitalization varies too. Once you’ve calculated the total market cap you can then categorize the company. While there’s no official standard, some common ones include:

- Micro Cap Company: Market cap that is below $250 million

- Small Cap Company: Market cap that is between $250 million and $2 billion

- Mid Cap Company: Market cap that is between $2 billion and $10 billion

- Large Cap Company: Market cap that is above $10 billion

These categories are a useful tool as they help to quickly tell investors what type of investment the company is. For example, large cap companies are often big, slow moving, have low risk and can give lower, but more stable returns. Micro or small cap companies on the other hand can grow much quicker to give outstanding returns, but also have a higher chance of failing.

Usually investors try to have a diversified portfolio of different stock types with different market caps in it. This is done to try and balance risk and growth to get the best of both worlds. When buying shares, just as with crypto, it’s always important to do proper research before investing in anything.

FAQ

Is A High Market Cap Good Or Bad?

Both high and low market caps have their pros and cons. High market cap stocks tend to be large and well established meaning they can be more stable and less risky. Low market cap stocks in contrast are more risky, but can have much better returns. Note that this relationship has not been proven to be the same in the cryptocurrency world.

What Was The Highest Coin Market Cap?

On the 10th of November, 2021 there were approximately 18,866,020 bitcoin in circulation trading at a market value of $69,044.77 USD per coin. This resulted in a market capitalization of $1,302,600,011,715 or roughly $1.302 billion USD

Is Market Cap Same As Equity Value?

No. market capitalization is the current value of all outstanding shares in a company (share price x number of shares). Equity on the other hand is more accurate and is calculated by adding up all company assets and then subtracting any debts it has.