Note: The Bitcoin Power Law Theory and the bitcoin prices it displays do not constitute investment advice. Historic performance is no guarantee of future performance and you should always consult a financial planner before investing in any asset.

Contents

What Is The Bitcoin Power Law Theory?

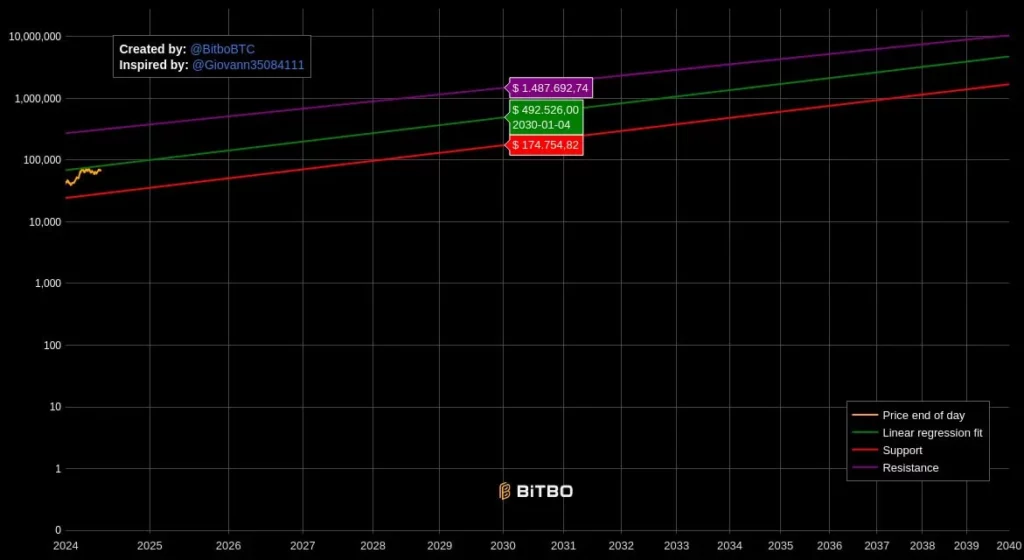

The Bitcoin Power Law Theory (BPLT) was originally discovered and noted by Giovanni Santostasi, a physicist and financial analyst, on Reddit back in 2018. In simple terms, it’s a chart that plots the price of Bitcoin versus time and then predicts what that price will be all the way out to 2040 using a power law model.

In statistics, a power law is a functional relationship between two quantities, where a relative change in one quantity results in a relative change in the other quantity proportional to a power of the change

Wikipedia

Unique to the power law model is that both the X and Y axis are logarithmic. In a number of other Bitcoin price charts, such as the Bitcoin Rainbow Chart or the Bitcoin Stock To Flow Chart, only the Y axis (price) is logarithmic. Having both axis be logarithmic is what’s called a log-log graph. Also unique to the power law model is that the future price is modeled by an equation with a power (the x^n term) in it, specifically:

While it might seem strange to try and model Bitcoin’s price like this, power law fits are extremely common in nature as well as in human made phenomena. In fact, the power law model even fits to other aspects of Bitcoin such as the price, Hash Rate and number of addresses.

Bitcoin is more similar to a city and an organism than a financial asset

Giovanni Santostasi

How To Interpret The Power Law Model

Interpreting the power law model is quite straight forward, simply pick a date and it will predict what range the Bitcoin price will be in at that time. Usually the model is drawn with three lines through it:

- Top: The resistance line

- Center: The linear regression fit line (the actual power law)

- Bottom: The support line

Generally speaking, these three lines can be thought of as your low, average and high price targets. Interestingly Giovanni Santostasi also points out that many people incorrectly try and fit the Bitcoin network to a S-curve type growth pattern as that’s what many other technologies such as cars, TV’s, the Internet, mobile phones etc have all been adopted in.

In reality Bitcoin’s growth, and thus price, does have an underlying s-curve mechanism of adoption, but due to the Difficulty Adjustment curbing its growth it’s instead best fit using his proposed power law model.

Why Display Bitcoin Price On A Power Law?

When displaying data it’s often useful to change the axis to get the data to fit a specific trend, in this case a straight line. Depending on what trend the data fits, you can then infer other things about the data you’re working with.

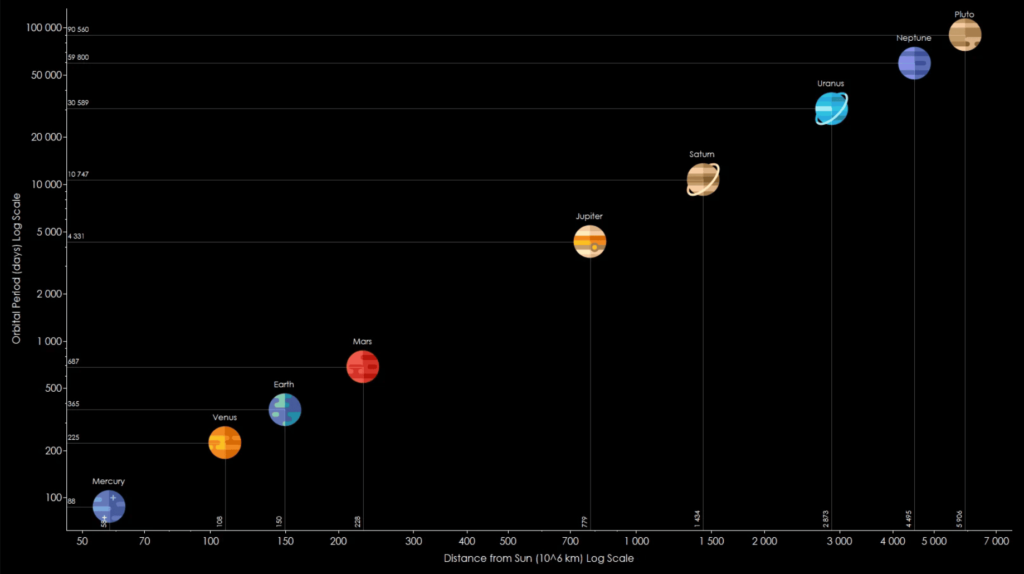

For example, other things that are a straight line on a log log graph and thus follow the power law model include everything from the size of craters on the Moon, cloud sizes, the length of a planets orbit, the size of power outages and more. These all also have interesting properties and consequences in common due to their straight line trend.

Displaying the price on a power law chart also makes the data visually easier to interpret as it’s just a simple straight line. The function of this straight line can then also be easily calculated using simple math. As a result we can better understand the relationship between the price and time.

Bitcoin Price Predictions

Obviously if we’re mapping out the price versus time, people are going to use it to predict the Bitcoin price out into the future. Everyone loves NgU technology after all! This process is referred to as technical analysis, but we should also note that it’s also called “astrology for men” as it’s definitely a guessing game.

Sure, the power law model has been incredibly accurate over the past 15 years, right back to the genesis block even, but things can and do always change. Historic performance is no guarantee of future performance, so always take the predictions with a giant grain of salt!

What Will The Price Of Bitcoin Be At The End Of 2024?

Looking at the chart, the range for what the Bitcoin price could be at the end of 2024 is:

- High: $375,000

- Medium: $80,000

- Low: $30,000

That’s a pretty huge range, but it still gives you something to work with, especially if you try and narrow it down using the price from previous Bitcoin Halving cycles as a reference guide. Whether or not these prices will be reliable is anyone’s guess though!

How Much Will Bitcoin Cost In 2035?

Extrapolating out even further to the start of 2035, we have to assume the power law model will be even less accurate, but we can still get our predicted range:

- High: $4,500,000

- Medium: $1,400,000

- Low: $500,000

While prices at this scale is pretty huge, it shows that as the years go on there are indeed diminishing returns. That is, the rate at which the price goes up is slowly reduced over time. This has been true since the launch of Bitcion and has always served as motivation for people to buy bitcoin sooner rather than later.

Criticisms OF The Bitcoin Power Law Theory

The full theory of the Power Law has of course had a number of detractors over the years. Giovanni Santostasi even criticizes the other models such as stock to flow (multiple times) so this isn’t a surprise, but let’s have a look at some of the concerns.

How Can The Bitcoin Price Go Up Forever?

The BPLT should not be used to make predictions beyond 2040 at most. Ray Kurzweil’s technological singularity will come next and all the predictions are off

Giovanni

Having something go up forever is obviously not a very scientific or realistic result. The power law model already takes this into account though as it’s only officially ever plotted out until 2040. Geovanni also agrees that the price will eventually stop going up according to his own model and has left the option open for adding in a “tapering component” later on if needed.

The technological singularity that he refers to in the quote above is where we as a species achieve Artificial General Intelligence (AGI). After this point, basically all bets are off on what the capabilities of humanity, with AGI, could be. As Bitcoin’s price is a percentage of the world wide GDP, it could indeed continue going up for a long, long time if the world as a whole became far more productive through technology.

Logarithmic Time Scale Is Weird

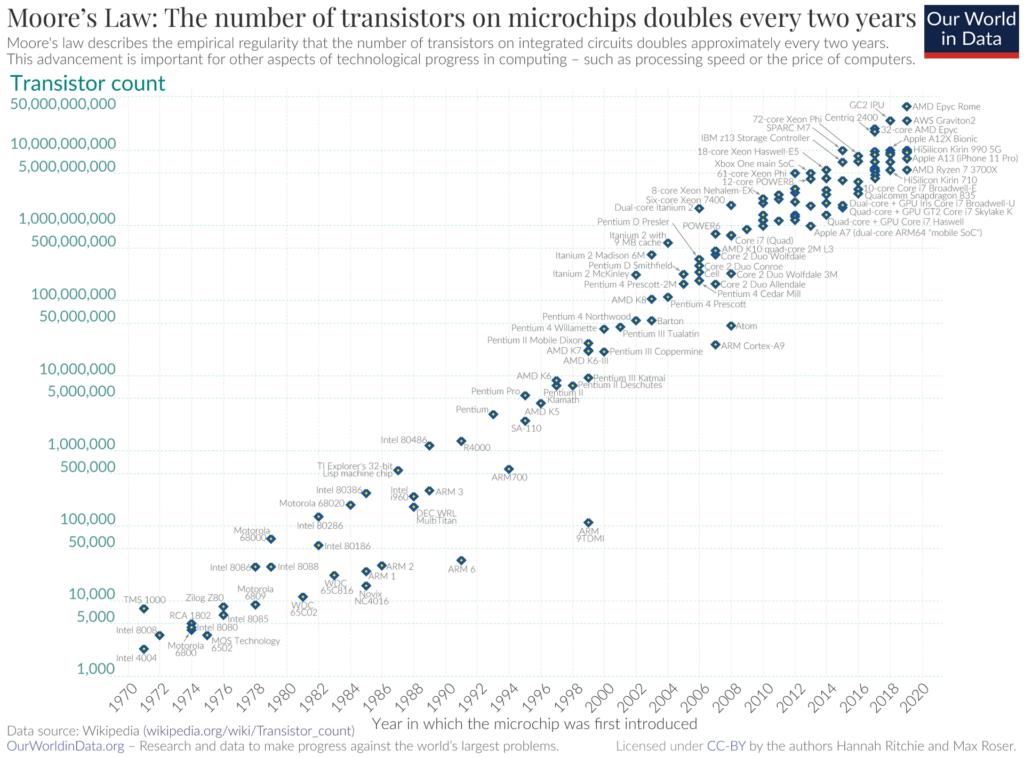

We admit, it’s kind of weird for most people to see a chart modeled with the time axis in log form. We’re pretty accustomed to seeing the Y axis in log form – Moore’s Law is a very common example of this – but having the time axis be shown in log form isn’t too widely seen.

That’s for the average reader though, in science and physics it’s quite common to see log time which is where Geovanni comes from. To us, the fact that the developer of this model is an actual scientist and physicist that regularly performs scientific analysis in a formal manor greatly elevates the model.

As Bitcoin is still a very new field, there’s not a great deal of formal scientific study aimed at it. As a result, the little study that’s done is usually performed by arm chair experts or those who don’t bother with the formal rigor that is expected in science.

While there’s nothing wrong with that per say, as fellow scientists we can absolutely attest to the fact that formal science is very different to just YOLOing it with some excel spreadsheet and a few hours of analysis. The Dunning–Kruger effect is real and can result is some huge mistakes.

Further Investment Advice

If you’re interested in market sentiment, market cycles and even the history of investing, we have a number of other excellent investment guides and resources to help below.

- Bitcoin Stock To Flow (S2F) Model

- Bitcoin Rainbow Chart

- How To Invest In Bitcoins: A Beginners Guide To Keep You Safe

- Bitcoin Lightning Node Profitability

- What Is Exit Liquidity & Why Learning About It Will Save You Thousands

- Dollar Cost Averaging Crypto

FAQ

Is The Power Law Model Accurate?

No model is ever 100% accurate and most often break down at one point or another. So by a strict definition no, it’s not 100% accurate at all times, but that’s not the point of a model. The power law that it plots (the main linear regression fit line) has been highly accurate over the life of Bitcoin and is there to give the reader a guide on how over or under valued the current price is as well as where the price may go in the future if the model remains relevant.

What About Scarcity, Supply And Demand?

While many other models take into account the supply and demand dynamics of Bitcoin, the Power Law Model doesn’t use them as inputs at all. The only inputs are time and price. While some see this as making the model less accurate, as it ignores the data, other see it as a benefit as simpler, more reductive laws can be more accurate and generalized.

Does Bitcoin Follow The Power Law?

So far, yes. The estimated price that the power law predicts has thus far proved to be accurate. This price is predicted in the US Dollar currency and it has been accurate since it was created back in 2018.

What Is The Power Law Prediction For Bitcoin?

The Power Laws predicted price for Bitcoin is extremely wide depending on which trend line and date you chose. For example the support line at the start of 2024 estimates the price to be around $30,000 USD. Meanwhile the resistance line in 2030 is over $1.5m! In general, following the main linear regression fit line it predicts Bitcoins price will be around $100,000 by 2026 and around $400,000 by 2030.

How Much Will Bitcoin Cost In 2045?

The creator of the power law model, Giovanni Santostasi, has explicitly stated that it should not be used past 2040 as it’s unknown what factors may disrupt the model that far out. We could have nano robots that are mining asteroids in space and super intelligent AI that takes over the world. The price given at this 2040 end point is around $4,000,000 USD per bitcoin.

Will The Price Of Bitcoin Be 10 Million?

Highly unlikely, but not impossible. While the power law model does go up as high as $10 million dollars, this is only at the very final stages around 2040 which is where the model ends. Even at this time period, the $10 million dollar price target is at the very top of the resistance line, meaning that it’d only ever get to such a high value at that time if it was a massive bubble.