If you’re a normal person then you don’t actually control your money. We like to think we do, but in reality fiat currencies like the USD are controlled by a small group of immensely powerful people like Jerome Powell, chair of the Federal Reserve. You can physically hold your cash, but you don’t control it… they do.

Money is one of the most important things in life, but we don’t control how much it gets inflated away, debased, seized or frozen. Shouldn’t we have that right? You’ll likely work for 90,000+ hours of your life (40 hours per week, 48 weeks per year, from ages 18 to 65) surely it’s worth spending 100 hours or so learning about how it works and how to take control of it?

When introducing Bitcoin for beginners one of the most important things to note is how Bitcoin – magic Internet money as some describe it – fully allows for you to take back control of your money. We’re getting a bit ahead of ourselves though, first let’s explain what Bitcoin is.

Contents

What Is Bitcoin?

Bitcoin is the first and most globally recognized cryptocurrency. That means it’s a currency backed by maths and cryptography, rather than by a single country or government.

It’s free for anyone in the entire world to own and you can use it by sending or receiving it with other people just like any other money. Unlike fiat money though, it cannot be stopped or censored and its rules cannot be changed, no matter how rich or powerful a country or person is. In short, a select few powerful elites can’t control it because no one controls it.

>> Deeper Dive: 4 Breakthrough Characteristics Of Bitcoin & Why It Has Value

They say any advanced enough technology is indistinguishable from magic. Given the power that Bitcoin let’s you wield and that most people still don’t fully understand it even now, it’s no wonder it was coined as “Magic Internet Money” by mavensbot (one of the members of the Reddit Bitcoin community) back in Feb of 2013. “Perfect” was the response of ManboobsTheClown.

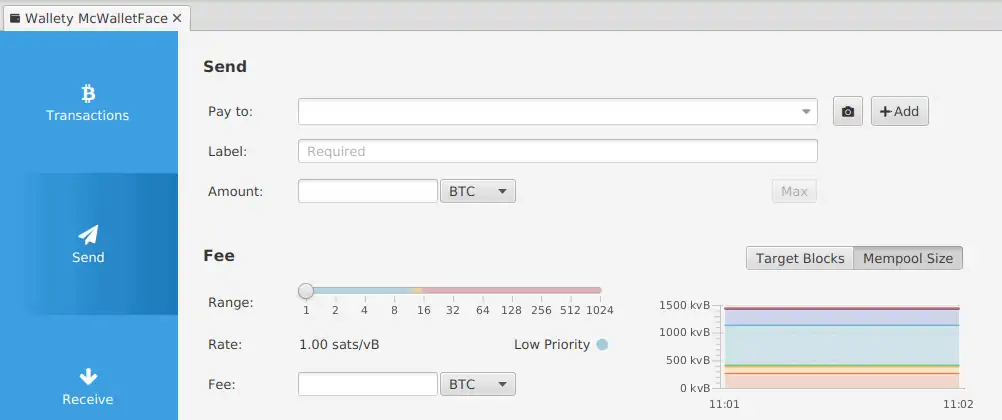

Just like you need an email client to send and receive emails, you also need a special program called a “wallet” to send and receive bitcoins. There are many different wallet software programs (just like there are many different email programs) and they are free for anyone to use on desktops, laptops, phones or tablets.

People use Bitcoin to send and receive monetary value just like they would with other currencies because it has its own special properties and can do things those other currencies can’t. For example, Bitcoin can be sent to anyone, anywhere in the world within a few minutes even if they have no bank account or are using a different currency than you are.

Sending Bitcoin

When sending any payment you always need to know where you’re sending it to. When using the Bitcoin network this “where” is represented by an automatically generated address. Bitcoin Wallet software is able to generate essentially infinite addresses for no cost. It goes like this:

- Wallets manage and store your Private Keys

- The wallet software uses your Private Keys to generate your Public Keys

- These generated Public Keys are what people refer to as Bitcoin Addresses

A Bitcoin Address is a string of 26-35 alphanumeric characters that’s used to receive bitcoins.

eg: bc1qelem0ann687r2e9jax542lja7q8cu8s35h96pc

The other extremely important thing to remember is that Bitcoin addresses should only ever be used once.

Don’t reuse addresses ever!

Once you have the address you want to send the payment to you simply open up your wallet software and paste it into the “Pay to” field. Be sure to double check that it has pasted the correct address and that it hasn’t been altered by malware or copied incorrectly.

The final two steps are to set your mining fee and broadcast the transaction. If it sounds pretty simple that’s because it is. While some of the terms might be a bit unfamiliar at first, it’s about the same as sending an email.

While this might not sound like anything special when compared to say, sending some money via PayPal or your bank, this simplicity extends to all types of transactions and final settlement only takes a few minutes.

You could be sending $50 to your friend or $5 billion dollars to your billionaire friend on the other side of the world in a war torn country with no banking infrastructure or even electricity. Both transactions take minutes, require no “accounts” or permission from any government or business, are unstoppable and are simple to send in seconds.

If you’re wondering about the fees, you can learn more about them in our piece: Bitcoin Transaction Fees And Where They Go. Most good wallet software like Sparrow Wallet however automatically set the right fee for you, but you can always set whatever fee you want.

Buying Bitcoin

Buying bitcoin is no different to trading other currencies such as the USD for EUR. You can buy a whole bitcoin (1 BTC) or fractions of a bitcoin (0.0005 BTC). Buying bitcoins can be done in many places and comes in two types:

- Non-KYC/AML Decentralized Exchanges (DEX)

- KYC/AML Centralized Exchanges (CEX)

Centralized Exchanges (CEX)

KYC (Know Your Customer) or AML (Anti Money Laundering) rules require you to surrender all your personal information (name, address, DOB, drivers license, photo etc) to a private company for permanent record keeping and sharing with many third parties and governments before they allow you to transact. Some examples include Binance, Coinbase, eToro or PayPal.

To buy bitcoins through them you’ll need to create an account, give up all your private information and then fund that new account with fiat money like USD, EUR or other cryptocurrencies.

Keep in mind you’re sending funds to a completely independent company that isn’t regulated or backed by your government. There is no “Federal Guarantee” if the company goes bankrupt or simply steals your money and centralized exchanges going bankrupt is very, very common. We don’t recommend using them.

>> Learn More: Crypto Exchange Bankruptcies

If you buy through a CEX you also link your Bitcoin Addresses to your personal identity forever. This is extremely dangerous to you in multiple ways as covered in our piece on Bitcoin Privacy.

Decentralized Exchanges (DEX)

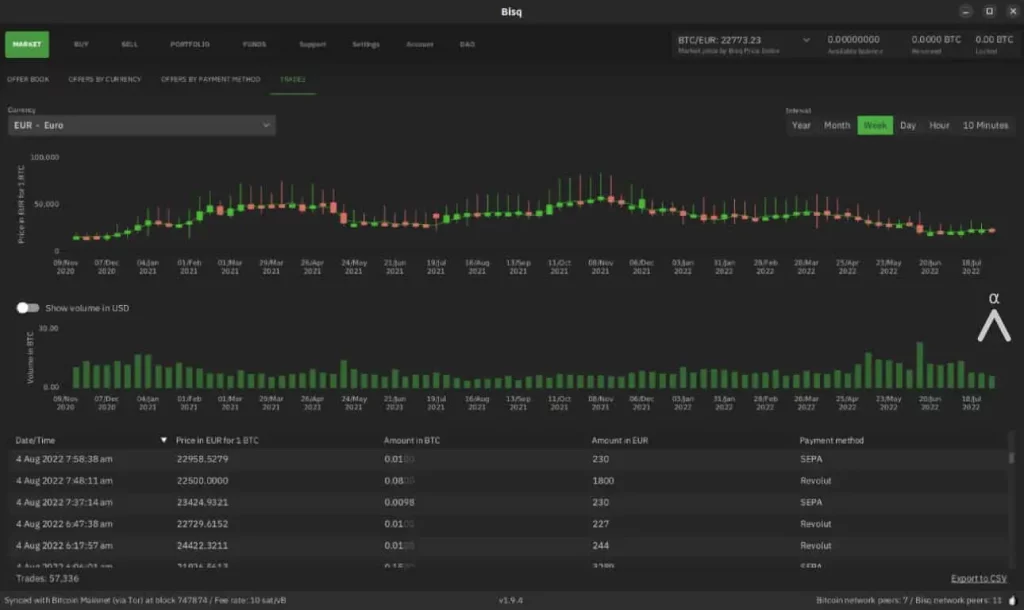

No KYC Crypto Exchanges like Bisq or Peach Bitcoin completely side step all the issues Centralized Exchanges have. This is because you don’t have to reveal your real world identity to use them.

When you open a program like Bisq (or the new Bisq2) for the first time, it creates a random profile that isn’t linked to your real name. When the trade occurs, it only goes from you to the receiver (or visa versa) and there are no other companies or entities involved.

Dive Deeper: Bisq Ultimate Quick Start Guide For Beginners

After you’ve bought your first bitcoins you should transfer them to your own Bitcoin Wallet. A Bitcoin wallet is simply software that:

- Manages your private keys which gives you access to spend your bitcoins

- Generates new Bitcoin Addresses so you can receive bitcoins

- Creates and broadcasts transactions to the network so you can spend your bitcoins

They come in many shapes and sizes such as this software wallet called Sparrow Wallet.

We have a whole in depth guide on wallets here: What Is A Bitcoin Wallet? This explains the difference between custodial and self-custodial, private and public keys as well as the many different types of software and hardware wallets.

Blockchain & Mining

Just like any type of money, Bitcoin needs a way of keeping track of who owns what bitcoins. This is referred to as a ledger and is essentially just a big database / file that is constantly updated to show who owns what. For example it might say “Bill owns 1 bitcoin”.

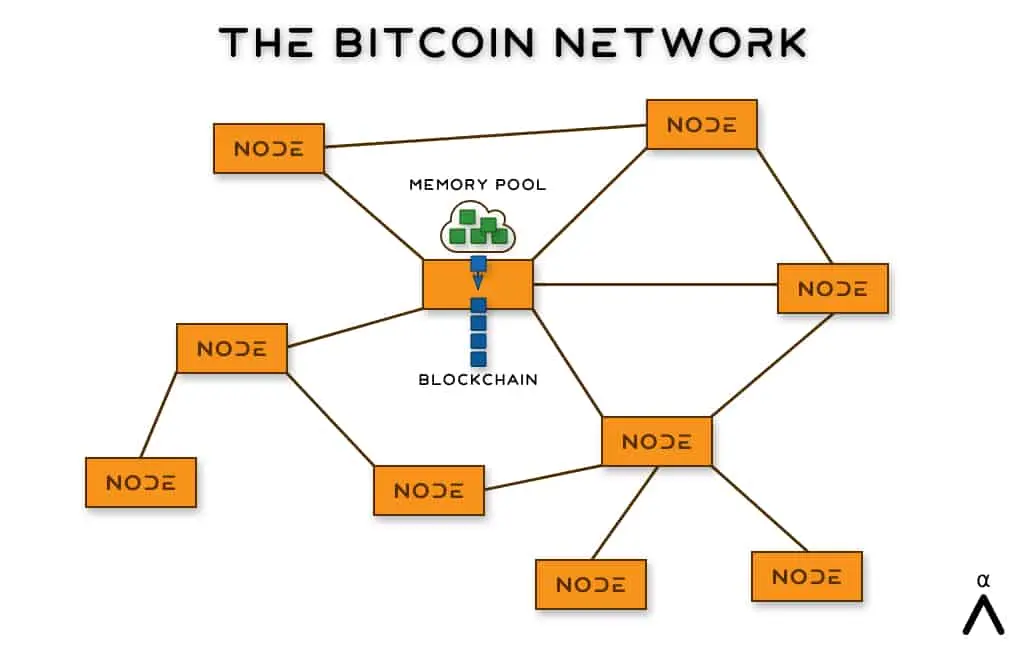

When a transaction is broadcast and ownership of various bitcoins change hands, it’s bundled together into a “block”. This block is then added or “chained” onto all the existing ones. All these individual blocks, chained together form the Blockchain which is stored on all Bitcoin Full Nodes.

A great way to visualize the blockchain and this process is to look at mempool.space as shown above. You can see each block – live! – as transactions from all over the world are added to it and then sealed forever into the ever growing Bitcoin blockchain. The blockchain is Immutable – meaning it can never be altered – and transparent.

The Bitcoin network has thousands of nodes in it. Each node is capable of mining and contains both the Mempool (shown with green transactions) as well as a full copy of the Bitcoin blockchain (with the blue blocks).

The mempool is just all the most recent transactions that haven’t yet been confirmed into the blockchain. Mining takes those transactions in the mempool, bundles them together and confirms them into the blockchain.

How mining works in detail is beyond the scope of this simple starters guide but we have very deep and detailed pieces if you’re interested in it. We have an overview piece on What Is Bitcoin Mining? as well as a very special, in depth look at Proof of Work (PoW) that has been reviewed by Adam Back, the inventor of Proof of Work and cited author in the Bitcoin Whitepaper, for accuracy and correctness.

New to Athena Alpha? Start today!

How To Invest In Bitcoin

To begin with, you should always consult a registered financial professional on whether or not you should invest in anything, even Bitcoin, as only they will have access to your full financial situation, personal details and thus be able to make a properly informed opinion on whether it is a good investment for you or not.

As Bitcoin has seen phenomenal growth over the past decade – going from under $100 to more than $20,000 USD per bitcoin at a growth rate of 200%+ per year – there has been a huge rush to speculate and day trade with it. As such, it should be made clear that speculating is very different to investing.

Speculative Trading refers to conducting a financial transaction that has substantial risk of losing value but also holds the expectation of a significant gain

Investopedia

Investing, broadly, is putting money to work for a period of time in some sort of project or undertaking in order to generate positive returns

Investopedia

One of the key differences between the two is how long you trade/invest for. For the purposes of this piece, we are exclusively referring to the risks of investing in Bitcoin, not day trading / speculating.

We believe that this is basically just gambling and shouldn’t be done unless you’re 100% happy to lose all your money. With all that out of the way there are a few different ways most people invest with Bitcoin.

- Speculative Trading: As noted above, this is essentially gambling and involves trying to “buy low and sell high” in order to make money. This is not recommended

- Mid Term Investing: This is where people buy and hold bitcoins for a reasonable amount of time (usually 5-10+ years). They normally expect to sell their bitcoins back for fiat in the future once they have appreciated in value or the funds are needed for something. This investing is a way for the person to preserve their purchasing power assuming bitcoins price increases at a rate higher than inflation

- Bitcoin Maximalists: These investors believe that Bitcoin will be the future world reserve currency. As such, when they buy bitcoins they never plan to convert them back into fiat currencies again. They may buy goods or services with them, but they are moving to a new financial system forever, not simply “investing” for a defined period of time

- Bitcoin Mining: Mining bitcoins can be very profitable if you have the right circumstances. This includes plenty of start up capital and access to a cold environment that also has plenty of excess, cheap or free power. Even if you have all this it’s still by no means an easy path to go down as mining companies routinely go bankrupt due to many reasons

For a deeper look, check out our beginners guide on How To Invest In Bitcoins.

Bitcoin Investing Risks

No investment comes without a certain amount of risk. We think Bitcoin is fantastic and a complete game changer for humanity, but would never ignore those risks. We don’t hide things from our readers, especially when it comes to investments. Risks of investing in Bitcoin include:

- Volatility: Bitcoin’s still a highly volatile asset that changes price every second, every day

- No Insurance: Deposits in banks are usually insured by the government in case the bank goes bankrupt, Bitcoin has no backup or insurance policy

- Protocol Risk: Although the Bitcoin network, protocol and cryptography that secures it have been battle tested over the past 10+ years, it’s still always possible that someone, somewhere finds a design flaw. Quantum computers could also succeed where classical computing has so far failed to crack its encryption which may shatter the worlds faith in Bitcoin. That being said the protocol and code behind Bitcoin is quite possibly the most reviewed and hardened in existence. With a Market Cap of a trillion plus dollars, this effectively serves as a “bug bounty” which anyone able to compromise the network would be able to claim. So far, no one seems up to the task

- Fraud / Bankruptcy: While holding your own Private Keys secures you against this risk, many users still allow other third parties to custody their funds for them (or hold the private keys on their behalf). This trust in a third party such as a centralized exchange then exposes them to other risks such as Crypto Exchange Bankruptcies, being a victim of hacking, being shut down by a government or simply doing fraudulent things. To avoid this, it’s recommended you always remove your bitcoins from any exchange and hold your own private keys. This also greatly increases your Bitcoin Privacy too.

- Regulation: As Bitcoin is still very new, regulations are still quite unknown and are evolving as time goes on. As Bitcoin grows and draws more attention upon itself, regulation is expect to increase

- Hacking: While this is a risk with virtually all assets in today’s modern world, Bitcoin is often stored by the user and not a financial institution and as such, may not be secured as well if the user isn’t very technical. This can lead to users losing their bitcoins to any number of hacking tricks that wouldn’t otherwise be possible. It should be noted though that using a dedicated Hardware Crypto Wallet can significantly eliminate this risk.

- Fungibility: While the Bitcoin network sees all bitcoins as equal, countries, governments or even private companies may mark certain bitcoins. This mark may mean they don’t get processed by them or are otherwise censored in some way by merchants. You could still send/receive them using your own Bitcoin Wallet, but this marking reduces the fungibility of bitcoins and could potentially strand your asset if this happened to you. This risk could potentially be solved via Bitcoin Mixers and coin mixing protocols such as CoinJoin, but again this is a risk that will likely evolve over time as Bitcoin grows.

To help mitigate these real risks we recommend:

- Always taking full control of your private keys and never trusting third parties

- Start small with an amount of money you’re fully willing to lose

- Like with everything online, assume everyone (including us!) is a scammer

- Learn as much as you can about Bitcoin from us and others. The more you understand Bitcoin, the more confidence you’ll have and the higher a level you’ll achieve

- Don’t get greedy. Don’t buy shitcoins. Don’t try and time the market, just DCA sats

Bitcoin vs Other Investments

Bitcoin has been by far the best investment over the past 3, 5 or even 10 years compared to virtually every other major asset class. It’s gone through a number of huge bear and bull markets too, from gaining almost 3,000% in just three months to loosing almost 40% in one day it has been – and still is! – a wild ride for investors.

As you can see in the above chart with all assets indexed to the S&P 500 at the start of 2000, Bitcoin is head and shoulders above everything else. That being said we must stress that past performance is no guarantee of future returns. Bitcoin is still highly volatile and you should consult a financial professional before investing in it yourself.

Bitcoin For Beginners Further Reading

- 10 Awesome Bitcoin Tips For Beginners

- Understanding Bitcoin: The Irresistible Journey

- Bitcoin, Not Crypto

- Debunking The Top 10 Bitcoin Myths

- How Does Bitcoin Work For Dummies?

- When Did Bitcoins Start? The Big Bang Of Crypto

- What Is A Bitcoin Address & How To Get The Best One

- A Beginners Guide To Bitcoin Privacy

- Is Bitcoin Cryptocurrency? And How Do They Work?

FAQ

How Much Money Do I Need To Start Investing In Cryptocurrency?

There are no minimum amounts needed when buying Bitcoin, however due to mining and trading fees you’ll likely want to buy at least a few dollars or more to make it worth your while.

How Can I Invest In Bitcoin?

If you’ve decided that investing in Bitcoin is right for you then we suggest doing a few things to help mitigate the risks that are present with Bitcoin:

– Start small with an amount of money you’re fully willing to lose

– Always taking full control of your private keys and never trust third parties

– Assume everyone online (including us!) is a scammer

– Learn as much as you can about Bitcoin from us and others

– Don’t get greedy. Don’t buy shitcoins. Don’t try and time the market, just DCA sats

We also only recommend buying your bitcoins from Non-KYC Exchanges such as the ones listed on our Best Crypto Exchanges list as these preserve your Bitcoin Privacy and ensure you don’t lose your funds when the next crypto exchange goes bankrupt.

What Are Altcoins?

Bitcoin was the first cryptocurrency and started a Cambrian explosion resulting in thousands of alternative or “alt” coins being created after it debuted in 2009.

There are substantial differences between what Bitcoin is, how it’s governed, its network and what it’s used for when compared to all other cryptocurrencies out there. It’s because of this that all other cryptocurrencies are shitcoins.

Do not touch them.

How Do You Mine Cryptocurrency?

We try to entirely focus on Bitcoin, so we don’t have any information on how to mine other cryptocurrencies. However if you want to know about Bitcoin mining you can learn all about it with our beginner piece on What Is Bitcoin Mining?

Otherwise the best path is to go to the specific cryptocurrencies home page and get information directly from the source on how they recommend to do it. Some cryptocurrencies don’t really allow for “home miners” to participate, while others use very different hardware from GPU’s to CPU’s to even Hard Drives.

How Does A Blockchain Work?

In order to keep track of who owns what tokens or coins, cryptocurrencies use blockchain technology. This is referred to as a ledger and is essentially just a big database / book that is constantly updated to show who owns what. For example it might say “Bill owns 1 bitcoin”.

When a transaction is broadcast and ownership of various coins change hands, it’s bundled together into a “block”. This block is then added or “chained” onto all the existing ones. All these individual blocks, chained together form the blockchain.