With the year quickly coming to a close we thought we’d do something fun. You’ve no doubt heard about the Bullish Case For Bitcoin, well today we’re looking at the bullish Bitcoin price prediction for next year!

To Be Clear: This is just us coming together and discussing what factors look bullish for Bitcoin over the next twelve months. Nothing more. This is not financial advice and we do not know your personal financial situation. Anything you read below may not eventuate as described and you should do your own research as well as speak to a certified financial planner so they can give you proper financial guidance with all the information in front of them.

Most importantly this is not some recommendation to start day trading the Bitcoin market like a cocaine inhaling degenerate from the Wolf of Wall Street.

Contents

Bitcoin’s Price Right Now

As of right now, the second last week of 2023, the current price of Bitcoin is trading at around $42,000 USD. There’s of course the usual price fluctuations that are always present in the crypto world, but overall let’s just call it an even 42, it is the answer to everything you know.

Bitcoin’s Historical Price Performance

Bitcoin started the year at about $16,540 so it’s so far gone up around 154%. If we look over the past 10 years of Bitcoins price performance, 154% is the third highest yearly return behind 2020 (298%) and 2017 (1,387%).

| Year | Start | End | Return |

|---|---|---|---|

| 2009 | $0 | $0 | 0% |

| 2010 | $0.0025 | $0.10 | 3,900% |

| 2011 | $1 | $30 | 2,900% |

| 2012 | $5.31 | $14 | 164% |

| 2013 | $20 | $755 | 3,675% |

| 2014 | $767 | $317 | -59% |

| 2015 | $314 | $431 | 37% |

| 2016 | $434 | $960 | 121% |

| 2017 | $998 | $14,839 | 1,387% |

| 2018 | $14,093 | $3,809 | -73% |

| 2019 | $3,692 | $7,240 | 96% |

| 2020 | $7,244 | $28,837 | 298% |

| 2021 | $28,665 | $48,022 | 67% |

| 2022 | $48,082 | $16,540 | -66% |

| 2023 | $16,541 | $42,208 | 155% |

| 2024 | $42,208 | $93,508 | 122% |

| 2025 | $93,508 |

Of course, past performance is never indicative of future performance, especially with how quickly Bitcoin changes, so we should take these data points with a big of a grain of salt. Things are changing not just quickly, but in big steps now too with Bitcoin fully entering into the institutional space.

We have accounting rule changes, Bitcoin ETFs and more which we’ll get into below, but for now lets dig deeper into some more concrete data to help us understand what has really increased Bitcoin’s price over the years.

What’s Historically Affected The Price Of Bitcoin

While it’s borderline impossible to directly correlate specific events to an increase in the spot price of Bitcoin, there’s a few that most would agree are at least relevant.

Increased Adoption

Increased wallets, increased transaction volume, increased mining Hash Rate, increased trading volume, increased number of Bitcoin Nodes all point to a healthy and growing ecosystem for Bitcoin. While this is more of a slow burn factor rather than a single day increase event, it helps form the underlying basis for everything else.

If there’s no actual users of Bitcoin, then everything else is basically moot. The more countries that adopt Bitcoin as legal currency, the more users that understand it and start storing their wealth in it, the more companies that use it as their reserve asset, the more miners and politicians and teachers there are the more room the current bitcoin price has to grow on a solid ground.

If the bitcoin price was surging while at the same time on chain metrics were clearly showing that no one was actually using it, it’d be more likely that there was a Bitcoin bubble being created or some illegal things happening behind the scene. True growth comes from increased adoption, demand and use of the Bitcoin network.

Increased Ecosystem

With increased demand and use also comes a broader, more mature ecosystem. This includes things like hardware Crypto Wallets, non-KYC Crypto Exchanges, bigger and more responsible financial institutions offering Bitcoin related services, more refined and solid regulations and accounting rules.

More user friendly and battle tested software wallets, more alignment by companies around the world on how standard things like sending and receiving bitcoin should be done. This common work flow then leads to more understanding by existing and newer users.

Think of the difference between the early Internet with Netscape Navigator, Internet Explorer, Ask Jeeves and how that user experience compares to the sleek, smooth and much more unified work flows that have saturated everything from phones to laptops to fitness devices.

There are now devices for men, women, small wrists, big wrists, gamers, photographers, business workers and a thousand others.

Bitcoin serves just as diverse a range of people and one hardware wallet might not suit someone who’s vision is poor and thus needs a big screen. The more it expands, the more users can be on boarded and the more adoption in general grows leading to more demand and higher bitcoin prices.

Increased Liquidity

Bitcoin’s Volatility has been extreme over the past decade mainly due to its low liquidity in markets around the world. Its Market Cap is tiny compared to other more mature assets like bonds or gold which means its price will fluctuate more if and when large investors enter the market.

However with increased adoption this liquidity grows allowing for those with more and more capital under management to enter the market without adversely affecting the price too much. As bigger players enter the game price increases along with liquidity which again helps bitcoin’s growth.

Five years ago the market cap was barely $70 billion where as it’s bounced around between $300 billion and $1.2 trillion over the last 2-3 years. This extra order of magnitude increases the adoption of bitcoin for the financial world leading to more demand, more liquidity and higher prices.

The Halving

Another core reason for Bitcoin’s price increases is its unique supply and demand setup. The Bitcoin Halving every four years throws a absolutely ginormous spanner into the supply side of the economic equations causing a huge price spike and rising demand almost like clock work.

Supply, demand and their relation to price is economics 101. If demand remains the same and bitcoins supply is cut in half then bitcoin prices simply have no other option but to increase. Interestingly this increase seems to happen in general over the course of about 6-18 months after the actual halving event.

Many have also noted that these price increases are decreasing, showing a sort of diminishing return behavior. This somewhat makes sense, as the more of these halving events we have, the more people become aware of them and can price them in.

As each even cuts the supply in half, each one reduces the supply by a smaller and small amount. The 2024 halving reduced the block rewards by 3.125 BTC where as the last one reduced it by 6.25 BTC. This smaller amount, in bitcoin unit terms at least, could explain why the price increases of each event is also diminishing.

Speculation And Hype

Finally we can’t not mention FOMO. Hype, speculation, NgU technology, a surging greed index and market cap, memes, it all feeds into a very powerful factor that can sky rocket bitcoins price to extreme highs as well as gut wrenching lows.

Speculation and hype then also attracts day traders that are looking to make a quick buck which further distorts the price and volatility of Bitcoin. You get price swings with financial markets going crazy due to all the hype and the high volatility turns into extreme volatility.

These price swings are temporary though and are most common around the halving events causing some of the most bullish price action in bitcoins history. The entire crypto world jumps on the band wagon with market sentiment usually going into the stratosphere until something breaks and the whole house of cards comes tumbling down.

New to Athena Alpha? Start today!

Bullish Signs For 2024

Now that we understand many of the main factors that contribute to bitcoins price, let’s see how they and other things stack up for 2024 specifically.

Bitcoin Halving

The Bitcoin Halving (also called Bitcoin Halvening) happens every 210,000 blocks or roughly every 4 years and is when the block reward for Bitcoin miners is halved. Note, the existing total supply of bitcoin remains the same, it’s only the supply of newly minted bitcoins that is halved.

Currently in 2023 the block subsidy is 6.25 BTC, but next year it will reduce to 3.125 BTC once the Bitcoin Blockchain hits a block height of 840,000.

As this impacts the annual flow side of the stock to flow ratio it increases Bitcoins scarcity. Each 4 years this happens again and again shocking the delicate supply and demand balance that has a huge impact on the price of any asset.

| Total Supply | Yearly Increase | S2F Ratio | |

|---|---|---|---|

| Bitcoin (2023) | 19,249,608 | 328,500 (1.68%) | 58 |

| Bitcoin (2025) | 19,800,515 | 164,250 (0.83%) | 120 |

| Bitcoin (2029) | 20,400,590 | 82,125 (0.40%) | 248 |

| Bitcoin (2033) | 20,700,852 | 41,062.5 (0.19%) | 504 |

2024 will see yet another of these halvings, likely leading to increases in the bitcoin price as the new supply and demand balance sorts itself out.

Do note however that according to historical data this price increase tends to happen over many, many months rather than at the actual time of the bitcoin halving.

Bitcoin ETFs

The bitcoin halving alone is a huge positive outlook for the bitcoin price, but when combined with the fact that multiple Bitcoin ETFs look like they will be approved around January some time, we could potentially be seeing some new price highs.

An exchange-traded fund or ETF is a group of securities that behaves similar to a mutual fund, but that can be bought and sold on an exchange just like a stock. For example, the SPDR S&P 500 ETF (with the ticker symbol SPY) tracks the S&P 500 index.

We’ve recently done a whole piece on what a spot Bitcoin ETF is and why both retail and institutional investors might want to buy it, so we won’t go into too much detail again.

But once approved by the SEC, Bitcoin ETFs will open the flood gates for quite literally hundreds of trillions of dollars of capital that previously just couldn’t buy Bitcoin before.

Whether they’ll actually buy bitcoin in any great quantity is unknown, there’s still a lot of uncertainty around cryptocurrency markets after all, but it seems reasonable to assume at least a small percentage will make the investment decision to get into digital currencies.

With trillions of dollars under management between almost a dozen companies that are filing for a Bitcoin ETF it could put a lot of pressure on the buy side of things pushing the bitcoin price higher and higher.

Huge ETF Marketing Campaign

While most might think of the cringe worthy crypto ads played by FTX at the super bowl when we say marketing campaign, what we’re really referring to is the financial advisors and sales army. BlackRock and all the other financial institutions have hundreds of employees on tap that will be calling new and existing clients to sell them their shiny new Bitcoin ETF product.

Will they also run TV ads? Sure. Are they running them already? Absolutely. But even if the calls don’t end up in a sale now, it’ll still be a major financial institution calling and discussing with people about all things digital assets and bitcoin.

From discussions about the circulating supply of Bitcoin to the blockchain technology underpinning it, they will have to educate and explain Bitcoin to their investor clients in order to sell them on it meaning better understanding and faster adoption of the masses.

Making major investment decisions also isn’t something people take lightly, so having the biggest and most powerful investment companies in the world answering their questions on “what is bitcoin” will go a long way to orange pilling a critical segment of the powerful and influential.

If they’re not talking directly to the investor they’ll be talking to the ones that give investment advice. Even if these people already know everything about the cryptocurrency market having major firm names like BlackRock or Fidelity now officially behind things will greatly bolster their sales pitch.

As Bitcoin is FOSS and has no company, no CEO and no marketing department, it’s been a very slow burn over the past 15 years to make new people aware of it and grab their attention. Once approved, it’s likely the ETF campaign will be the biggest world wide bitcoin marketing push ever, all happening in 2024.

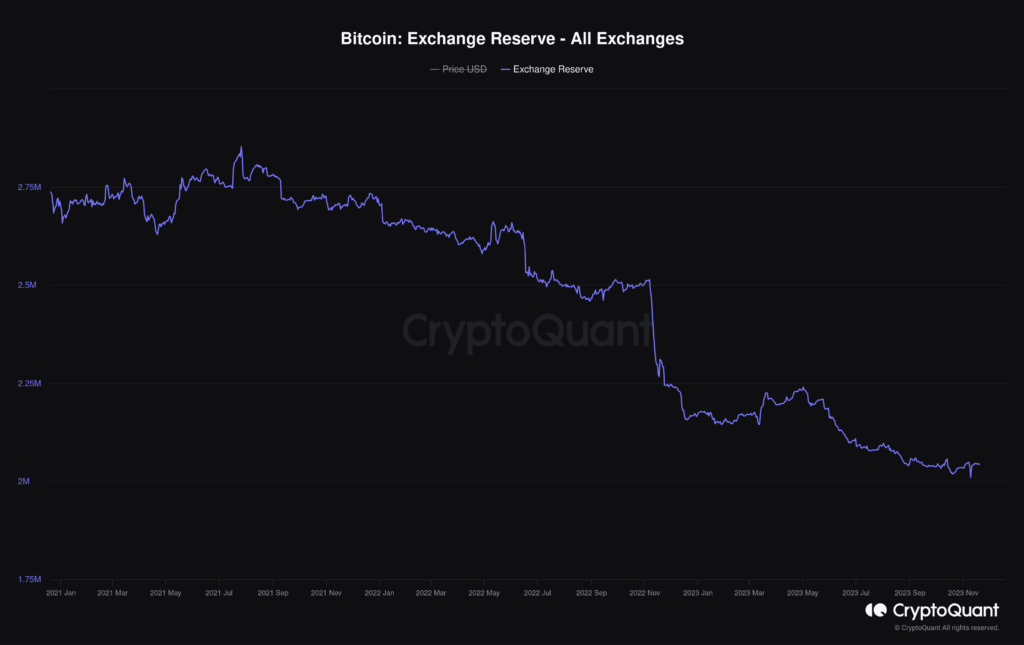

Plummeting Supply On Exchanges

The supply of bitcoins on crypto exchanges is and has been plummeting for years now. Since its peak of around 2.8 million bitcoin in July 2021, the number has dropped to only around 2 million now in Dec 2023. That’s a decrease of around 27,000 BTC per month or 330,000 BTC (11%) per year.

While at that rate it’d take another 6 or so years to fully drain all the reserves, we’re already at a 5+ year all time low and with the reduction in newly minted bitcoin happening around April next year this rate of decline could speed up even more.

Add on the added buying from the ETFs and it all compounds on each other to what looks to be a historical demand and supply crunch. For all of bitcoins short history, it’s always been possible to go to an exchange and purchase some bitcoin if you were willing to pay the price. In 2024, that might not be the case anymore.

Bitcoin Climate FUD Being Laid To Rest

While the new marketing campaign will soon be rising up, it also seems that much, if not all of the general climate change and energy use FUD is being firmly laid to rest. Where as years ago you’d see hit piece after hit piece being run about how bitcoin will boil the oceans and use up all electricity on Earth, now it’s the opposite.

We covered much of this a full year ago on Why Climate Change Activists Should Love Bitcoin, but now it seems the mainstream media is also catching up too.

From stabilizing energy grids to reducing global methane emissions to helping to fund larger renewables projects and more, Bitcoins ESG credibility has hugely expanded.

It’s leading all industries in renewable energy use and is on a legitimate path to becoming the first carbon negative industry with the help of methane flaring powered mining. The more people that understand its capabilities, the more good Bitcoin Mining will do which all helps to onboard new users and propel demand and prices upwards.

FASB Accounting Rule Changes

The Financial Accounting Standards Board or FASB is the entity responsible for setting the accounting standards for all companies in the USA. A few months ago it voted in a new change to adopt fair-value accounting for Bitcoin.

While this might sound a bit esoteric and boring – which it totally is – and we won’t bore you too much with the specific accounting details behind it all, it essentially makes bitcoin more attractive to companies that want to hold it on their books.

For companies that have huge cash balances that are just slowly melting away like an ice cub sitting out in the sun, it’s now even more tempting to put some of it in bitcoin adding yet again to the overall demand.

FASB changing to a fair value accounting for bitcoin was one of Michael Saylor’s three key things that he says are needed to take bitcoin’s price to $5 million dollars per coin. The other two are a spot Bitcoin ETF and increased bank custody and collateralized lending of bitcoin.

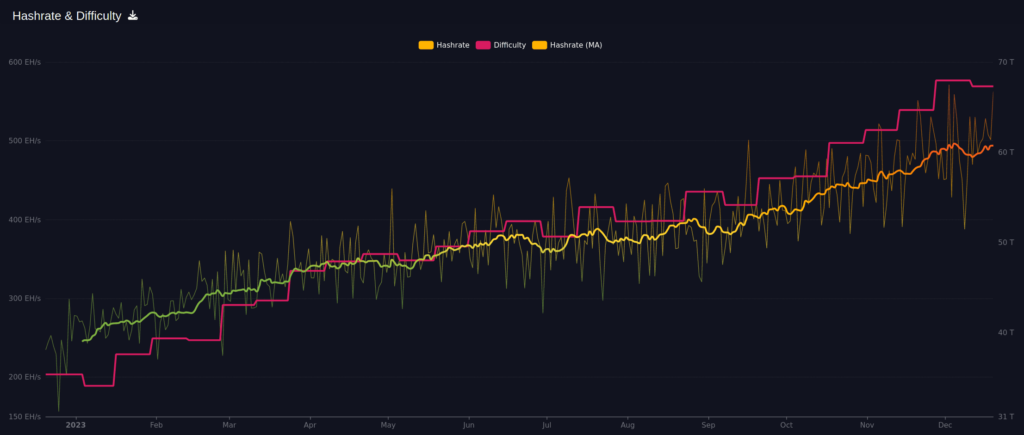

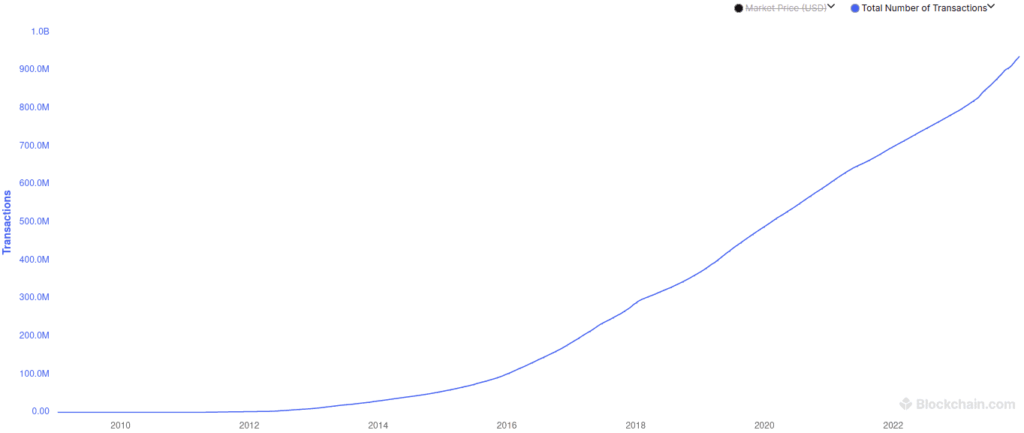

Increasing Metrics

Finally we thought we’d just summarize a number of various metrics that in general point towards a more positive future for Bitcoin in 2024. These metrics includes things like the hashrate absolutely obliterating its all time highs over and over again all through the year, now topping around 500 EH/s.

Number of Bitcoin addresses with 1 BTC, 0.1 BTC and 0.01 BTC in them all at all time highs. The Lightning Network growing exponentially since it was debuted and the continued exponential rise in the number of Bitcoin transactions.

There’s even more, but they all show good, healthy use of the Bitcoin network as more and more people, companies, investors and even nations continue to adopt the bitcoin standard. All solidly bullish for bitcoins price going into 2024.

Bearish Signs For 2024

While we don’t want to be entirely one sided here, there’s really not a great deal we can think of or find that spells trouble for Bitcoin. While a bear market is never out of the question, the vast majority of things all seem to be quite positive for the Bitcoin BTC price.

An ETF Flop

One potential is that all these Bitcoin ETFs may not bring in much capital or if they do, the companies that are running them may have already long since bought the bitcoins and thus there won’t be any new buying pressure.

As we stated earlier, while having yet another way for investors to get exposure to Bitcoin should be good for the Bitcoin price, the inflows may end up falling flat on the ground. No one really knows.

Price prediction is a notoriously hard thing to pull off and we don’t ever like to do it. Mainly because we prefer to focus on adoption not bitcoin’s price movements.

Regulation

Another potential downer for the bitcoin price could be severely unfavorable regulation in the USA or abroad. There’s been much talk and even proposed bills wanting to do everything from effectively banning “self hosted wallets” to FOSS itself.

While we don’t think these seem like truly legitimate possibilities, weirder things have happened before! So anything’s possible when it comes to the crypto industry.

Is Bitcoin A Safe Long Term Investment Decision?

Bitcoin is generally considered by the global investment community as being one of the more risky asset classes. This is mostly due to the volatility in its price, rather than its actual technology. We should also note that we are only talking about Bitcoin here, not any other digital currency.

How safe of an investment Bitcoin is can also change a lot depending on what risk factor you’re referring to. For example, while Bitcoins price is very volatile, it allows you to have far greater property rights than any other asset, meaning it’s extremely safe when it comes to seizure or confiscation risks. It’s also immune to the printing of money we see in most countries around the world.

Furthermore the core technology of Bitcoin is built on the SHA-256 cryptographic algorithm which is what safeguards much of the Internet, including existing financial institutions. As such, the Bitcoin Network is for all intents and purposes impossible to crack and very safe to use.

>> Learn More: Is Bitcoin Real? And Is It Safe?

While we’re very bullish on Bitcoin, we also don’t hide its risks. Investors should be fully aware of the following risks that are involved when buying Bitcoin as an investment:

- Volatility: Bitcoin’s still a highly volatile asset that changes price every second, every day

- Exchange Fraud / Bankruptcy: Many users still allow third parties to custody their funds for them which becomes a problem when they go bankrupt or collapse. To avoid this risk, it’s recommended to never keep your bitcoins on an exchange and take full self custody

- Hacking: While this is a risk with virtually all assets in today’s modern world, Bitcoin is often stored by the user and not a financial institution and as such, may not be secured as well if the user isn’t very technical. This can lead to users losing their bitcoins to any number of hacking tricks that wouldn’t otherwise be possible. Using a dedicated Hardware Crypto Wallet can significantly reduce this risk.

- Scams: There are a number of Bitcoin Scams that you should be aware of

- No Insurance: Deposits in banks are usually insured by the government in case the bank goes bankrupt, Bitcoin has no backup or insurance policy similar to stocks, real estate or bonds

- Regulation: As Bitcoin is still very new, regulations are still evolving as time goes on. As Bitcoin grows and draws more attention upon itself, regulation is expect to increase

- Protocol Risk: Although the Bitcoin network, protocol and cryptography that secures it have been battle tested for 10+ years, it’s still possible that someone may find a design flaw

Helping people understand Bitcoin in simple terms is what we specialize in here at Athena Alpha, so we have plenty of excellent resources available for free. Two main ones are our Beginners and Bitcoin 101 categories or you can start with our Understanding Bitcoin piece. Other great beginner pieces include:

- A Beginners Guide To Bitcoin Security

- A Beginners Guide To Bitcoin Privacy

- 10 Awesome Bitcoin Tips For Beginners

- What Is A Bitcoin Worth? The Perfect Money

- How To Invest In Bitcoins: A Beginners Guide To Keep You Safe

- Dollar Cost Averaging Crypto

- What Is Exit Liquidity & Why Learning About It Will Save You Thousands

- Why Does Your Bitcoin Address Change

The Bitcoin Singularity

There has never before been a truly finite asset like Bitcoin.

While other scarce assets like gold or real estate are extremely slow and expensive to create more of, humans have and always will be able to produce more of them, especially as technological advancements continue to bring the future closer and closer.

When it comes to Bitcoin’s supply though, it’s absolutely fixed. It has a maximum supply of 21 million coins and that’s all there ever will be, even in 1,000 years time. Compare this to fiat currencies which overwhelmingly die within just 35 years.

It doesn’t matter if the average price of bitcoin is one trillion dollars, the network will still only allow for the same amount of newly minted bitcoins each block. Each of those new blocks will also only be discovered on average every 10 minutes.

So what happens when demand permanently outstrips supply? When all the exchanges run bone dry and billions still want more bitcoin? Normally prices go up which encourages more production of the good, but this is fundamentally impossible with Bitcoin. When this finally does happen with Bitcoin, it will be like crossing into the singularity of a Black Hole.

No one can see what’s on the other side because it’s never happened before in all of human history. Obviously some people holding bitcoin will start to sell them as the price climbs higher and higher, but at some point there is simply going to be too much demand and no supply.

Bitcoin Price Prediction

Will true bitcoiners sell finally once the price of a single bitcoin is $100,000? $500,000? $1 million? $5 million? $10 million? It’s impossible to say because although you may think “who wouldn’t sell!??” maybe they’re waiting for more or will just never sell period. The higher the bitcoin price goes, the more incentivized holders are to wait for higher prices.

When we cross the event horizon of this singularity is anyone’s guess, but it’s one of the most fascinating things we see coming with Bitcoin and possible in 2024. Once crossed, what will bitcoin be worth? It’s possible that things like market capitalization, market value and price predictions will all just not make any sense anymore.

At the very least we’re sure about one thing… the memes will be amazing!